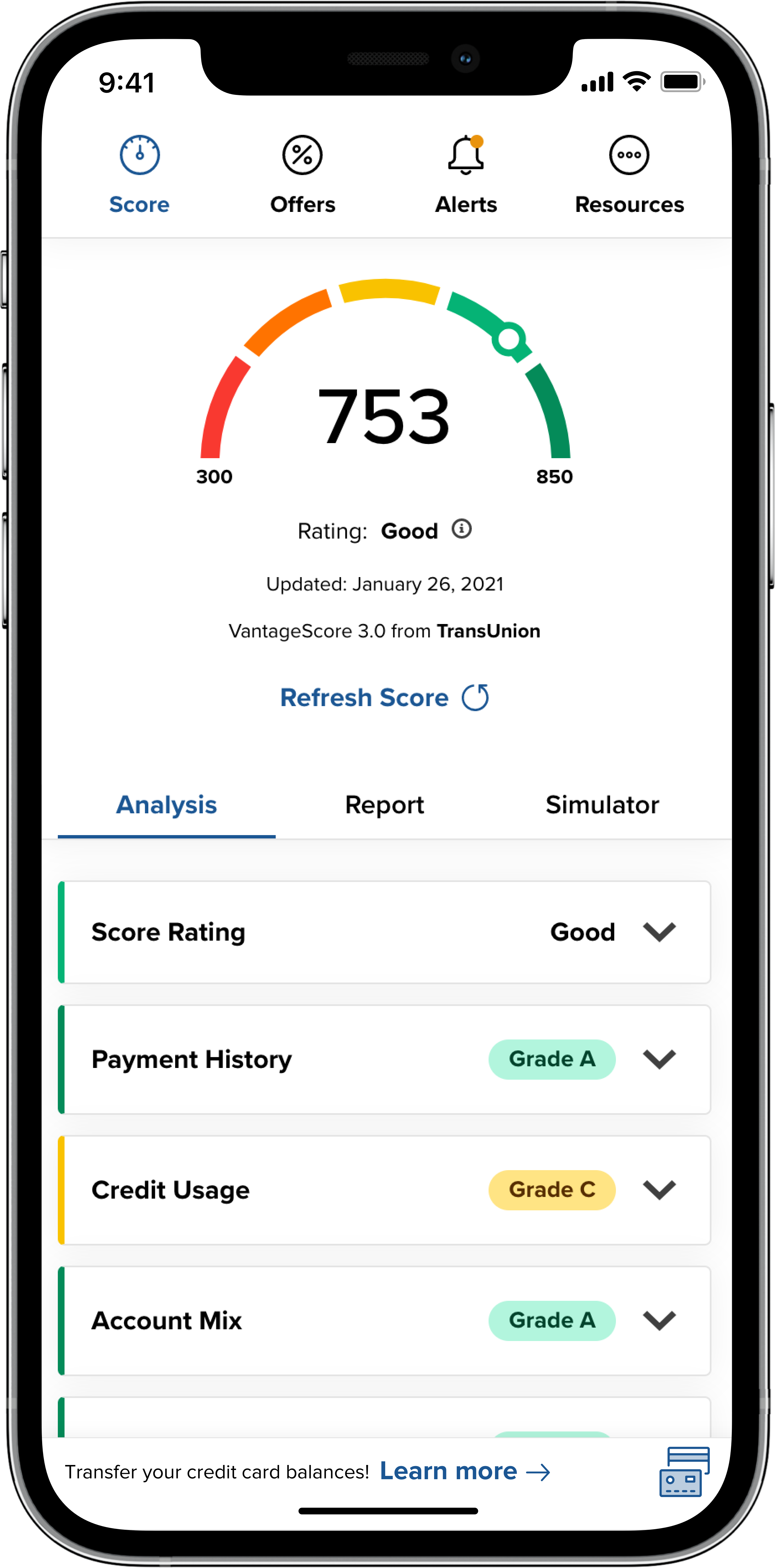

Have you ever wondered how your credit score impacts your financial freedom? Understanding your credit score is more than just a number; it’s the key to unlocking opportunities and achieving your financial goals.

Whether you’re looking to secure a loan, rent an apartment, or get better rates on insurance, your credit score plays a crucial role. But how do you analyze this mysterious number and make it work in your favor? Imagine having the power to improve your financial standing with a few strategic moves. By diving into the intricacies of credit score analysis, you can uncover the secrets to boosting your score and enhancing your financial health. We’ll break down the elements that make up your credit score, reveal tips for improvement, and introduce you to tools that can simplify the process. If you’re a business owner seeking innovative solutions, consider exploring the Revenued Business Card Visa® Commercial Card. This unique financing tool offers flexible, revenue-based funding without the constraints of traditional loans. With features like the Flex Line and instant financing, Revenued adapts to your business’s needs, providing quick access to capital and personalized support. Stay with us as we guide you through the world of credit score analysis and equip you with the knowledge to elevate your financial game. Whether you’re an individual or a business owner, understanding your credit score can open doors to a brighter financial future.

Credit: capedcu.com

Introduction To Credit Score Analysis

Understanding your credit score is crucial for financial health. A good score opens doors to loans, better rates, and more financial opportunities. In this section, we’ll dive into the basics and importance of credit scores.

Understanding The Basics Of Credit Scores

A credit score is a number that reflects your creditworthiness. It ranges from 300 to 850, with higher scores indicating better creditworthiness. Scores are calculated based on payment history, amounts owed, length of credit history, new credit, and credit mix. Each factor influences your score differently, making understanding them essential.

|

Factor |

Impact on Score |

|---|---|

|

Payment History |

35% |

|

Amounts Owed |

30% |

|

Length of Credit History |

15% |

|

New Credit |

10% |

|

Credit Mix |

10% |

Regularly checking your credit score helps identify areas for improvement. Using tools like the Revenued Business Card Visa® Commercial Card can aid businesses in maintaining healthy credit through flexible financing.

The Importance Of Credit Scores In Financial Health

Credit scores play a vital role in financial decisions. A high score can lead to lower interest rates on loans. It can also increase chances of loan approval. Poor scores may lead to higher costs or denial of credit. Maintaining a good score is essential for financial stability.

-

Improved Loan Approvals: Higher scores increase approval chances.

-

Better Interest Rates: Good scores lead to lower rates.

-

Increased Financial Opportunities: More options for credit and services.

For businesses, tools like Revenued provide flexible financing options. This aids in managing cash flow and maintaining a good credit profile. Quick access to funds ensures businesses meet financial obligations timely. This can positively impact their credit score.

Credit: www.kemba.com

Key Features Of Credit Score Analysis Tools

Understanding your credit score is crucial for financial health. Credit score analysis tools simplify this process. They offer real-time updates and detailed insights. These features help manage and improve your credit.

Real-time Credit Monitoring: Staying Updated

Stay informed with real-time credit monitoring. This feature tracks changes in your credit score. It alerts you to any new activities. Knowing these changes helps you react quickly. Real-time updates can prevent fraud and errors.

Customized Alerts: Proactive Financial Management

Receive customized alerts tailored to your financial goals. These alerts notify you of important credit score changes. They help you manage your finances proactively. This feature ensures you never miss critical updates.

Detailed Credit Reports: Comprehensive Financial Insights

Access detailed credit reports for a deeper understanding. These reports provide comprehensive insights into your financial health. They include payment history, credit utilization, and more. This information guides better financial decisions.

Pricing And Affordability Of Credit Score Analysis Tools

Understanding credit score analysis is crucial for personal and business financial health. Choosing the right analysis tool can impact your financial decisions significantly. Pricing and affordability are key considerations when selecting these tools. Knowing your options can help you make an informed choice.

Free Vs. Paid Options: What To Expect

Free tools often provide basic credit score information. They are usually limited to simple reports and general advice. Paid tools offer more detailed analysis and personalized insights. These tools provide comprehensive reports, including credit score trends and actionable recommendations.

Here’s a comparison of free and paid options:

|

Features |

Free Tools |

Paid Tools |

|---|---|---|

|

Basic Score Information |

Yes |

Yes |

|

Detailed Analysis |

No |

Yes |

|

Personalized Insights |

No |

Yes |

|

Customer Support |

Limited |

Comprehensive |

Value For Money: Evaluating Cost Vs. Benefits

Evaluating cost vs. benefits is essential in selecting a credit score analysis tool. Paid tools offer value for money through detailed reports and expert insights. Businesses can benefit from tools that provide real-time data and predictive analytics.

Consider these benefits:

-

Detailed Reports: In-depth analysis of credit trends.

-

Predictive Analytics: Forecasting future credit score changes.

-

Real-Time Data: Access to the latest credit information.

-

Expert Support: Professional advice and guidance.

Investing in a paid tool often results in better financial decisions. It helps manage credit effectively and improves overall financial health.

Pros And Cons Of Using Credit Score Analysis Tools

Credit score analysis tools are essential for managing personal finances. They provide insights into credit health, helping to make informed decisions. But, like all tools, they come with both advantages and limitations. Understanding these can help users make the best use of these resources.

Advantages: Empowering Financial Decisions

Credit score analysis tools offer several benefits. They empower individuals to take charge of their financial health. Some key advantages include:

-

Informed Decisions: Users can understand their credit standing and make better financial choices.

-

Quick Monitoring: Regular updates help keep track of credit changes.

-

Improved Credit Management: Recommendations for improving credit scores.

-

Access to Detailed Reports: Comprehensive reports provide insights into credit behavior.

Tools like these help users align their financial actions with their goals. This can lead to better credit scores and financial stability.

Limitations: Understanding Potential Drawbacks

While beneficial, credit score analysis tools have limitations. Users should be aware of these potential drawbacks:

-

Cost: Some tools may require a subscription fee.

-

Data Privacy: Concerns about how personal data is used and stored.

-

Incomplete Information: Not all aspects of credit health may be covered.

-

Over-Reliance: Dependence on tools may lead to neglecting financial education.

Understanding these limitations is crucial. It helps users maintain a balanced approach to managing their credit health.

Specific Recommendations For Ideal Users

Understanding and managing your credit score can significantly impact your financial health. The Revenued Business Card Visa® Commercial Card offers a unique financing option. This section provides specific recommendations for users aiming to maximize their financial strategies using credit score analysis.

Best Practices For First-time Credit Score Users

For first-time users, understanding credit score basics is crucial. A credit score represents your financial reliability. Start by obtaining a free credit report from authorized agencies. Review your score carefully and identify areas for improvement. Pay bills on time to build a positive payment history. Avoid maxing out your credit cards to maintain a healthy credit utilization ratio.

-

Pay bills promptly to boost payment history.

-

Maintain low credit utilization for a better score.

-

Check your credit report regularly for accuracy.

Ideal Scenarios For Leveraging Credit Score Tools

Leveraging credit score tools can empower users to make informed financial decisions. The Revenued Business Card Visa® Commercial Card is suitable for businesses seeking flexible financing. Use tools to monitor credit changes and set alerts for significant updates. Businesses can benefit from scalable financing limits as their revenue grows. Ideal for companies needing quick access to funds without traditional loans.

|

Scenario |

Benefit |

|---|---|

|

Growing Business |

Flexible limits adapt to revenue increase. |

|

Immediate Funding Needs |

Access funds within 24 hours. |

|

Support Requirement |

Dedicated account managers assist users. |

Using the Revenued app, users can manage spending and transaction history efficiently. This provides control and transparency, fostering better financial management.

Credit: www.r1cu.org

Frequently Asked Questions

What Are The 5 Levels Of Credit Scores?

Credit scores are categorized into five levels: poor, fair, good, very good, and excellent. Poor scores range from 300-579, fair from 580-669, good from 670-739, very good from 740-799, and excellent scores are 800-850. These levels help lenders assess credit risk accurately.

What Is Credit Score Analysis?

Credit score analysis evaluates your credit history and financial behavior. It determines creditworthiness using factors like payment history, debt levels, and credit age. Lenders use this analysis to assess loan eligibility and interest rates. A good credit score can enhance financial opportunities.

What Are The 3 C’s Of Credit Analysis?

The 3 C’s of credit analysis are Character, Capacity, and Capital. Character assesses trustworthiness. Capacity evaluates repayment ability. Capital examines financial resources available to cover debts.

How Rare Is A 700 Credit Score?

A 700 credit score is considered good and common. Around 59% of Americans have scores between 700-749. It reflects responsible credit behavior and can lead to better loan terms and interest rates. Maintaining good financial habits can help keep or improve this score.

Conclusion

Understanding your credit score is crucial. It impacts financial decisions daily. A solid credit score opens doors to better financial opportunities. It’s vital to monitor and improve it regularly. Consider tools like Revenued for unique financing solutions. Learn more here. Their service offers flexible financing and real human support. Remember, managing credit wisely can lead to lasting benefits. Keep track, make informed choices, and use resources to enhance financial health. Happy credit managing!