Do you find tax season stressful and overwhelming? You’re not alone.

Managing taxes, especially payroll taxes, can be a daunting task for small business owners. With the need to comply with federal, state, and local tax laws, it’s easy to make costly mistakes. But what if there was a way to simplify the entire process, ensuring compliance and accuracy while saving you time and effort? Enter automated tax calculations. This innovative approach is revolutionizing how you handle taxes, making it easier and more efficient than ever before. Imagine a world where tax codes, forms, and compliance are no longer a source of stress but a seamless part of your business operations. With the right tools, you can have peace of mind and focus on what truly matters—growing your business. If you’re curious about how automated tax calculations can transform your tax management experience, you won’t want to miss this article. Discover how SurePayroll, a leader in payroll tax management services, is helping small businesses like yours navigate the complexities of tax compliance effortlessly. Learn more about SurePayroll’s services here. Get ready to unlock the secrets to stress-free tax management and see how you can benefit from six months free with their limited-time offer. Keep reading to find out how you can make tax season a breeze.

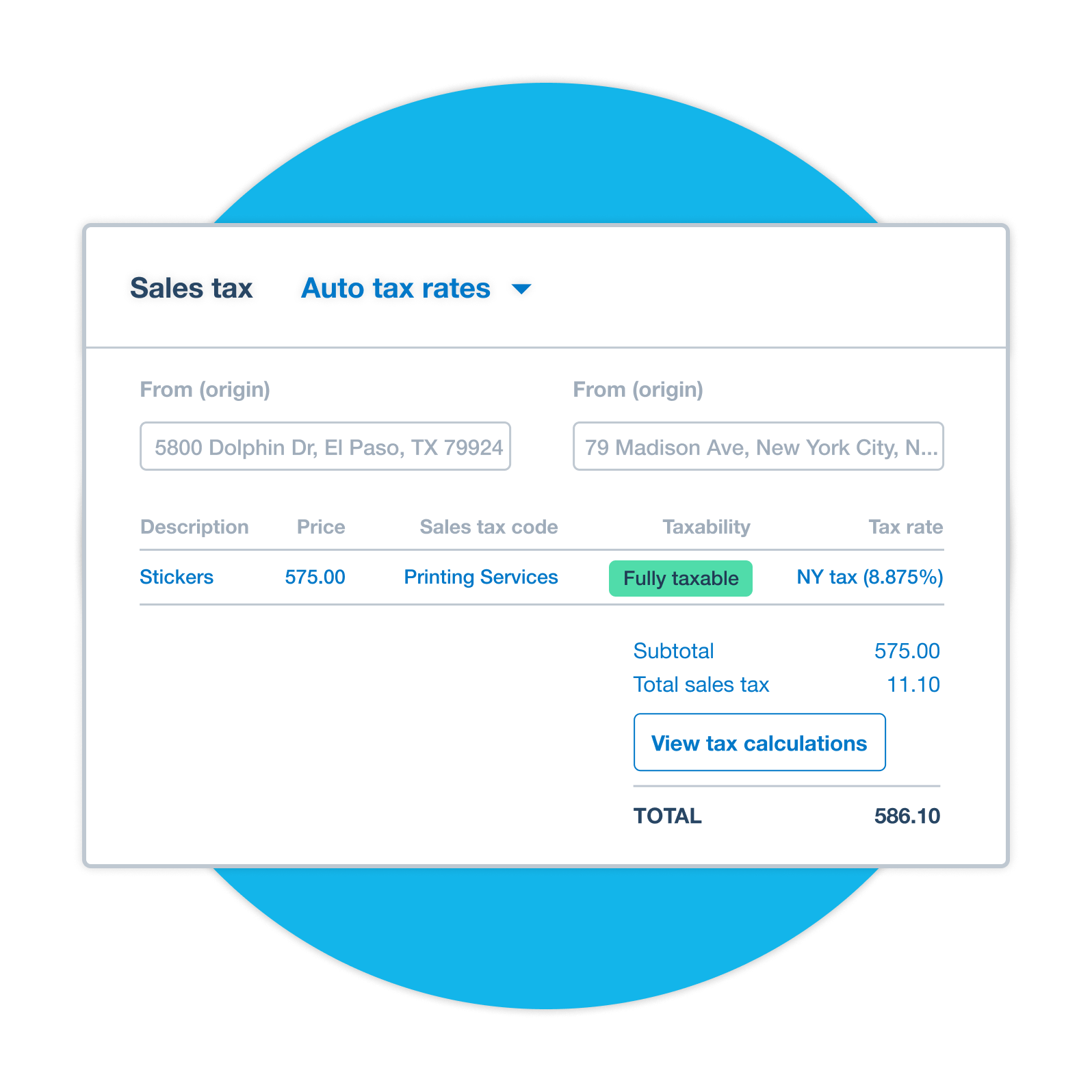

Credit: www.ecwid.com

Introduction To Automated Tax Calculations

Managing taxes can be challenging and time-consuming. Automated tax calculations simplify this process significantly. They reduce errors and ensure compliance with complex tax laws. This technology benefits both individuals and businesses.

Understanding The Role Of Automation In Financial Planning

Automation plays a crucial role in modern financial planning. It streamlines tasks, saving time and reducing human errors. Automated tax calculations ensure accurate and timely filing. They handle complex tax codes efficiently, which is vital for compliance.

For example, services like SurePayroll offer comprehensive solutions. They manage federal, state, and local payroll taxes. This reduces the workload on small business owners. They can focus more on growth rather than tax complexities.

How Automated Tax Calculations Benefit Individuals And Businesses

Automated tax calculations provide numerous advantages. Let’s explore some key benefits:

- Simplified Tax Management: Automation handles multiple tax jurisdictions easily. This is especially helpful for small businesses dealing with various tax codes.

- Avoid Mistakes: Tools and guidance prevent costly errors. This ensures accurate payroll tax management, crucial for small businesses.

- Legal Compliance: Automated systems help maintain compliance with tax mandates. They cover federal, state, local, city, and county requirements.

SurePayroll offers a practical solution. It supports over 6,000 U.S. tax codes. It also provides guidance on essential forms like Form W4 and Form I-9. This makes tax compliance less daunting for entrepreneurs.

For small businesses, SurePayroll offers a limited-time offer. They can get six months free when signing up for their services. This makes it an attractive option for those seeking cost-effective solutions.

Credit: www.xero.com

Key Features Of Automated Tax Calculation Tools

Automated tax calculation tools simplify managing taxes for businesses. These tools offer features that ensure accurate and efficient tax processing. Below are key features of automated tax calculation tools that enhance their usability and effectiveness.

Real-time Tax Rate Updates

Staying updated with tax rates is crucial for compliance. Automated tax tools provide real-time tax rate updates. This feature ensures businesses adhere to the latest federal, state, and local tax codes. For instance, SurePayroll supports over 6,000 active U.S. tax codes. This includes complex codes from states like Washington and Pennsylvania. Businesses avoid costly mistakes by using updated rates.

Integration With Financial Software

Seamless operations depend on integration capabilities. Automated tax tools integrate with various financial software. This reduces manual entry and errors, speeding up tax processing. SurePayroll offers solutions that work well with existing financial systems. This integration aids in direct deposit and smooth payroll processing. Businesses can manage taxes efficiently using these integrated solutions.

User-friendly Interface And Customization Options

A user-friendly interface is crucial for easy navigation. Automated tax tools offer customizable options to fit business needs. SurePayroll provides guidance on tax forms like Form W4, Form I-9, and Form 1040-ES. The interface allows users to tailor processes to their preferences. Small businesses benefit from simplified tax management, reducing complexity across multiple jurisdictions.

Below is a table summarizing the features:

| Feature | Description |

|---|---|

| Real-Time Tax Rate Updates | Ensures compliance with latest tax codes. |

| Integration with Financial Software | Facilitates seamless operations with existing systems. |

| User-Friendly Interface | Offers customization for efficient tax management. |

Automated tax calculation tools are vital for businesses aiming for efficient tax management. They provide essential features that ensure compliance and ease of use.

Pricing And Affordability

Exploring the costs involved in automated tax calculations is essential for businesses. Understanding the pricing and affordability can help in making informed decisions. Automated tax solutions, like SurePayroll, offer various pricing models. These models are tailored to meet the needs of small businesses. Let’s delve into the cost implications and available offers.

Cost Comparison: Automated Tools Vs. Traditional Methods

When comparing automated tools with traditional methods, cost-effectiveness stands out. Traditional methods often require hiring experts or extensive manual work. This can lead to higher expenses and potential errors.

- Automated Tools: These require an initial setup cost and a subscription fee. However, they save time and reduce the risk of costly mistakes.

- Traditional Methods: Involves manual calculations, often needing professional help. This can result in variable costs and higher error rates.

Automated tax solutions like SurePayroll provide compliance support for over 6,000 tax codes. This ensures accurate calculations and compliance with tax mandates.

Subscription Models And Free Trials

SurePayroll offers flexible subscription models to suit different business needs. A noteworthy feature is the limited time offer for small businesses. They can receive six months free when signing up. This allows businesses to test the service without immediate financial commitment.

Here’s a brief overview of the subscription benefits:

| Feature | Benefit |

|---|---|

| Compliance Support | Access to extensive U.S. tax codes |

| Form Management | Guidance on essential tax forms |

| Direct Deposit | Streamlined payroll processing |

These features simplify tax management and enhance efficiency. Businesses can avoid mistakes and ensure legal compliance.

Pros And Cons Based On Real-world Usage

Automated tax calculations have transformed how small businesses manage taxes. This technology offers numerous benefits but also comes with challenges. Below, we explore the advantages and challenges based on real-world usage.

Advantages: Accuracy And Time Efficiency

Automated tax systems, like SurePayroll, ensure high accuracy in tax calculations. These systems support over 6,000 active U.S. tax codes. This reduces the likelihood of errors significantly. Mistakes in tax calculations can be costly for businesses. Therefore, accuracy is crucial.

Time efficiency is another advantage. Automated systems streamline the entire process. They provide solutions for managing federal, state, and local taxes. This saves time for small business owners who often juggle multiple tasks.

Direct deposit features further enhance time efficiency. They eliminate the need for paper checks. This not only speeds up payroll processing but also simplifies tax management.

Challenges: Data Security And Software Complexity

Data security remains a significant concern for many users. Automated tax systems handle sensitive information. Protecting this data is vital to prevent security breaches.

The complexity of some tax software can also be challenging. While these systems offer detailed support, they can be overwhelming for new users. Understanding the various tax codes and features requires time and patience.

Ensuring legal compliance is essential. Users must familiarize themselves with the system’s capabilities. This includes knowing how it helps maintain compliance with federal, state, and local tax mandates.

Below is a table summarizing the pros and cons:

| Pros | Cons |

|---|---|

| High Accuracy | Data Security Risks |

| Time Efficiency | Software Complexity |

| Compliance Support | Requires User Familiarity |

Specific Recommendations For Ideal Users

Automated tax calculations offer precise solutions for various user groups. SurePayroll stands out with tailored features for individuals and businesses. It simplifies tax management and ensures compliance with complex tax codes. Below are specific recommendations for those who can benefit most.

Best Scenarios For Individuals: Simplifying Personal Tax Filing

Individuals often face challenges with personal tax filing. SurePayroll helps with compliance using over 6,000 U.S. tax codes. It provides guidance on essential tax forms like Form W4 and Form I-9. These tools simplify filing and reduce errors.

Key features for individuals include:

- Form Management: Expert assistance on filling out crucial tax forms.

- Direct Deposit: Streamlined payroll processing for quicker access to funds.

- Compliance Support: Ensures adherence to complex tax codes.

Ideal for those seeking to avoid mistakes and streamline their tax processes.

Ideal Use Cases For Businesses: Streamlining Corporate Tax Processes

Businesses manage intricate tax requirements. SurePayroll simplifies this with tools for legal compliance across federal, state, and local mandates. It helps businesses avoid costly errors and stay compliant.

Businesses benefit from:

- Simplified Tax Management: Handles multiple tax jurisdictions efficiently.

- Compliance Support: Keeps up with complex tax codes like those from Washington and Pennsylvania.

- Direct Deposit: Reduces reliance on paper checks, facilitating payroll.

SurePayroll is a smart choice for small business owners seeking hassle-free tax solutions.

| Feature | Individual Benefit | Business Benefit |

|---|---|---|

| Form Management | Guidance on tax forms | Efficient tax documentation |

| Direct Deposit | Quick fund access | Streamlined payroll |

| Compliance Support | Adherence to tax codes | Legal compliance |

SurePayroll offers a limited-time offer for small businesses and households. They can receive six months free upon signing up. This makes it an attractive option for users looking to ease their tax processes.

Credit: easydigitaldownloads.com

Frequently Asked Questions

Is There An Ai That Can Do My Taxes?

Yes, AI tools can assist with tax preparation. Services like TurboTax and H&R Block use AI to simplify the process. They help users navigate deductions, credits, and tax forms. Always verify details, as AI tools may not cover complex tax situations.

Consult a tax professional for personalized advice.

Can You Automate Your Taxes?

Yes, you can automate your taxes using tax software. These tools simplify calculations and filing processes. They integrate with financial accounts and ensure accuracy. Automation reduces errors and saves time, making tax season less stressful. Always verify information and consult a tax professional if needed.

Will Tax Preparers Be Automated?

Tax preparers face automation, but human expertise remains crucial. AI tools assist, but can’t replace nuanced decision-making. Many clients value personalized advice and complex problem-solving. Automation enhances efficiency, yet human tax preparers offer comprehensive understanding and strategic planning.

What Is The Formula To Calculate Tax?

To calculate tax, use this formula: Taxable Income x Tax Rate = Tax Liability. First, determine your taxable income. Then, apply the applicable tax rate based on your income bracket. Subtract any deductions or credits to find the final tax amount owed.

Always check current tax laws for accurate rates.

Conclusion

Automated tax calculations make life easier for small business owners. These tools simplify tax management, reducing stress and errors. SurePayroll offers a robust solution for managing payroll taxes efficiently. With compliance support, guidance on forms, and direct deposit, it simplifies your tax process. You can easily avoid costly mistakes and ensure legal compliance. Interested in a streamlined payroll experience? Check out SurePayroll for reliable tax management services. Embrace technology to handle taxes with ease. A smarter approach for your business needs.