Are you on the hunt for a secure personal loan? Perhaps you’re in need of funds for a dream vacation, home renovation, or unexpected expenses?

Whatever your reason, finding a reliable and secure option is crucial. You deserve peace of mind, knowing that your financial needs are met without compromising your personal information or assets. This is where Uphold comes into play. Uphold offers a unique and innovative platform that prioritizes your security and financial success. With features like early token discovery and one-step trading, Uphold simplifies and secures the process of trading and managing digital assets. Dive into this article to uncover how Uphold can transform your approach to personal loans and financial security. Your journey to a safer and more efficient financial future starts here!

Credit: benchmarkfcu.org

Introduction To Secure Personal Loans

Secure personal loans offer a practical way to achieve financial goals. They involve pledging an asset as collateral, such as a car or property. This reduces the lender’s risk, often resulting in lower interest rates for borrowers. Understanding these loans is crucial for making informed financial decisions.

Understanding The Purpose Of Secure Personal Loans

The primary goal of secure personal loans is to provide access to funds with favorable terms. By using an asset as collateral, borrowers can secure larger loan amounts. This is especially helpful for those needing funds for significant expenses, like home renovations or debt consolidation. Borrowers with less-than-perfect credit scores can also benefit. Collateral reduces the lender’s risk, making approval more likely.

How Secure Personal Loans Can Help Achieve Financial Freedom

Secure personal loans can be a stepping stone to financial freedom. They offer lower interest rates, reducing the overall cost of borrowing. This means more of your payment goes towards the principal, reducing debt faster. For those consolidating higher-interest debts, this can lead to significant savings.

These loans also provide an opportunity to improve credit scores. Consistent, timely payments reflect positively on credit reports. Over time, this can enhance your creditworthiness, opening doors to better financial products in the future.

Here’s a brief comparison of secure personal loans:

| Aspect | Benefit |

|---|---|

| Interest Rates | Typically lower due to collateral |

| Loan Amounts | Higher, depending on asset value |

| Approval Odds | Increased, especially with collateral |

| Credit Score Impact | Can improve with timely payments |

In summary, secure personal loans are a valuable tool in financial planning. By leveraging assets, borrowers can access funds, manage debt, and potentially improve their financial standing.

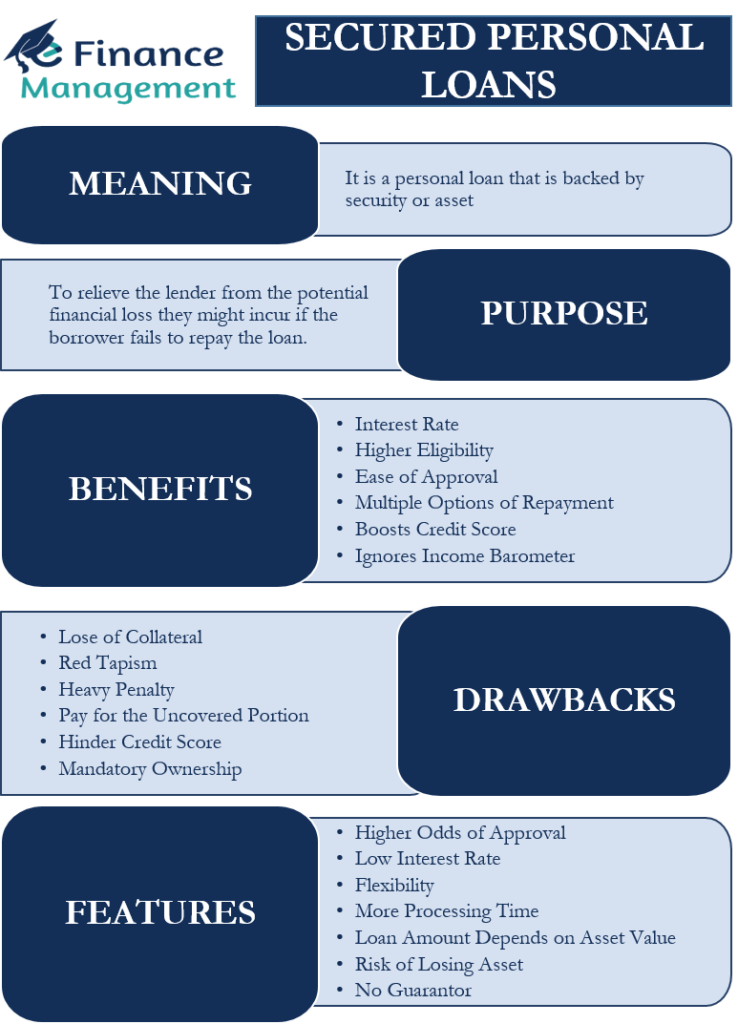

Credit: efinancemanagement.com

Key Features Of Secure Personal Loans

Secure personal loans offer a reliable financial solution by leveraging a borrower’s asset as collateral. These loans are designed to provide access to funds with benefits such as lower interest rates and flexible terms. Understanding the key features can help you make informed financial decisions.

Collateral-based Security: Ensuring Lower Interest Rates

Secure personal loans require collateral, often resulting in lower interest rates compared to unsecured loans. This collateral-based security minimizes the lender’s risk, allowing them to offer competitive rates. Typical collateral includes property, vehicles, or other valuable assets. Such arrangements benefit both lenders and borrowers by providing security and affordability.

Flexible Repayment Options: Tailoring To Individual Needs

These loans often come with flexible repayment options, allowing borrowers to customize terms based on their financial capacity. Borrowers can select from various repayment schedules, ensuring that monthly payments align with their income and expenses. This flexibility aids in managing financial commitments efficiently, reducing stress.

Loan Amount Range: Catering To Diverse Financial Requirements

Secure personal loans provide a wide loan amount range, accommodating different financial needs. Whether you need funds for home renovation or debt consolidation, these loans can cater to varied requirements. The available loan amounts often depend on the value of the collateral provided. This feature ensures that borrowers can access necessary funds without exceeding their repayment capacity.

Pricing And Affordability Of Secure Personal Loans

Understanding the pricing and affordability of secure personal loans is crucial. These loans offer a reliable way to access funds. The costs associated with these loans can vary widely. Let’s explore the key components that influence these costs.

Interest Rates Comparison: Secured Vs. Unsecured Loans

Interest rates are a key factor in loan pricing. Secured loans typically have lower interest rates. This is because they are backed by collateral. Unsecured loans, lacking collateral, usually have higher rates. Here’s a simple comparison:

| Loan Type | Typical Interest Rate |

|---|---|

| Secured Loan | 3% – 8% |

| Unsecured Loan | 10% – 20% |

Understanding Fees And Additional Costs

Besides interest rates, consider additional fees. These may include:

- Origination Fees: Charged for processing the loan application.

- Late Payment Fees: Imposed if you miss a payment deadline.

- Prepayment Penalties: Charged for paying off the loan early.

These costs can significantly affect the total loan expense. Always review the loan agreement carefully.

Affordability Analysis For Different Income Levels

Affordability varies based on income levels. Here’s a simplified analysis:

- Low Income: May struggle with high monthly payments.

- Middle Income: Better suited for moderate loan amounts.

- High Income: Can manage larger loans with ease.

Calculate your monthly budget before taking a loan. Ensure the monthly payments fit comfortably within your financial plan.

Credit: www.smbceo.com

Pros And Cons Of Secure Personal Loans

Secure personal loans offer a unique blend of benefits and challenges. These loans require collateral, which can be an asset like a car or property. Understanding the pros and cons helps you make informed financial decisions.

Advantages: Lower Rates And Easier Approval

One of the main advantages of secure personal loans is the lower interest rates. Lenders face less risk when loans are backed by collateral. This often results in more favorable rates.

- Easier Approval: Collateral reduces lender risk, increasing approval chances.

- Flexible Terms: Secure loans may offer longer repayment periods.

These benefits make secure loans appealing for those with less-than-perfect credit scores.

Potential Drawbacks: Risks Of Collateral And Eligibility Criteria

Despite the advantages, secure personal loans come with potential risks. One major risk is the threat to your collateral.

- Risk of Losing Assets: Defaulting could lead to loss of the asset used as collateral.

- Eligibility Criteria: Not all assets qualify as collateral, restricting loan access.

These drawbacks highlight the importance of assessing your financial situation before opting for secure loans.

Recommendations For Ideal Users Of Secure Personal Loans

Secure personal loans offer a reliable financial solution for individuals seeking stability and peace of mind. These loans are particularly beneficial for users with specific needs and profiles. Understanding who can benefit the most from secure personal loans can help potential borrowers make informed decisions.

Who Benefits Most: Profiles Of Ideal Candidates

Secure personal loans are suitable for individuals with diverse financial backgrounds. Here are some profiles that align well with these loans:

- Homeowners: Homeowners can leverage their property as collateral. This often results in lower interest rates.

- Credit Builders: Those seeking to improve their credit scores find secure loans advantageous. Timely payments can boost credit ratings.

- Stable Income Earners: Individuals with steady income sources can manage loan repayments effectively.

- Asset Owners: Asset owners can use vehicles or valuable items as collateral, ensuring loan security.

Scenarios Where Secure Personal Loans Are Advantageous

Secure personal loans shine in various scenarios where financial security is paramount. Consider these situations:

- Debt Consolidation: Consolidating high-interest debts into a single loan can reduce overall interest rates.

- Home Renovations: Financing home improvements using a secure loan can increase property value.

- Emergency Expenses: Unexpected medical bills or urgent repairs can be covered swiftly.

- Education Funding: Investing in education can be facilitated by securing personal loans against assets.

Each of these scenarios highlights the practical benefits of secure personal loans. They offer a structured approach to managing finances responsibly.

Frequently Asked Questions

What Is The Best Secured Personal Loan?

The best secured personal loan offers low interest rates, flexible terms, and quick approval. Compare lenders like Wells Fargo, TD Bank, and USAA for favorable terms. Ensure your collateral, such as a car or savings, is sufficient to secure the loan.

Research thoroughly to find the most suitable option for your needs.

Is Secure Loans Legit?

Secure loans can be legitimate if offered by licensed and reputable lenders. Always verify the lender’s credentials. Check for customer reviews and ratings. Confirm loan terms and conditions before proceeding. Stay cautious of unrealistic offers. Conduct thorough research to ensure the lender’s credibility.

What Is A Secure Personal Loan?

A secure personal loan requires collateral, like a car or house, to back the borrowed amount. It often offers lower interest rates due to reduced risk for lenders. If the borrower defaults, the lender can seize the collateral to recover the loan.

Is A Secured Personal Loan Good?

A secured personal loan is beneficial for lower interest rates and easier approval. It requires collateral, reducing lender risk. Borrowers with good collateral can access larger amounts. Carefully assess your ability to repay, as defaulting risks losing the collateral. Always compare options before deciding.

Conclusion

Exploring secure personal loans can enhance financial management. Consider platforms like Uphold for added security. They offer a user-friendly approach to managing digital assets. Uphold’s transparency and security measures build trust. Their features make trading and staking simple and efficient. Always research and choose platforms that align with your needs. Financial security starts with informed decisions. Make sure to stay updated on the latest trends and tools. This can help optimize your financial journey. Stay safe and invest wisely.