Are you keeping an eye on real estate market trends? Whether you’re a seasoned investor or just starting out, understanding these trends can be your secret weapon to making smart decisions.

The real estate market is a dynamic landscape, ever-evolving and influenced by economic shifts, interest rates, and even global events. But how do you navigate this complex world to make informed choices that secure your financial future? Imagine having a tool that not only simplifies this process but also opens doors to exclusive opportunities. That’s where EquityMultiple comes in. Designed for accredited investors like you, it offers a gateway to highly vetted real estate projects, helping you build a diversified portfolio with less risk than traditional investments. As you dive deeper into this article, you’ll discover the latest trends shaping the market and learn how platforms like EquityMultiple can empower you to take advantage of them. So, if you’re ready to gain insights and potentially transform your investment strategy, keep reading. Your path to smarter real estate investing starts here.

Introduction To The Real Estate Market Trends

The real estate market is continuously changing, influenced by various factors. Understanding these trends helps investors make informed decisions. Real estate trends show patterns and shifts that affect the demand, supply, and pricing of properties. For investors, recognizing these trends can mean the difference between profit and loss.

Understanding The Current Landscape

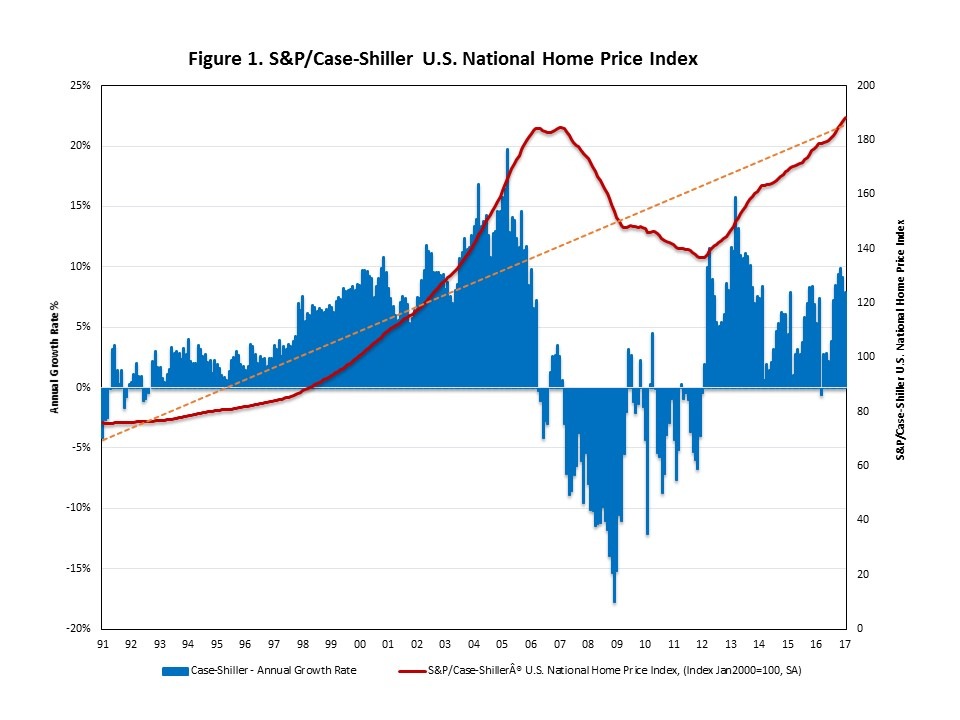

The current real estate landscape is shaped by economic conditions, government policies, and demographic shifts. Economic growth or decline can significantly impact property values and demand. Interest rates, for example, directly affect mortgage rates, influencing buyer affordability. Government policies, such as tax incentives or restrictions, can either boost or hinder real estate activity.

Demographic trends also play a critical role. An aging population might increase demand for retirement communities. Meanwhile, urbanization can drive up prices in city centers. These factors collectively form the current real estate landscape, which investors must navigate carefully.

The Purpose Of Analyzing Market Trends

Analyzing real estate market trends serves multiple purposes for investors. Firstly, it helps in identifying the best investment opportunities. By understanding market dynamics, investors can pinpoint areas with potential growth. This can lead to higher returns on investment.

Moreover, trend analysis aids in risk management. Investors can anticipate market downturns and adjust their strategies accordingly. This proactive approach protects capital and maximizes returns. Additionally, staying informed about trends ensures that investors remain competitive in the market.

For platforms like EquityMultiple, understanding market trends is crucial. With a focus on passive real estate investment, EquityMultiple offers access to vetted opportunities. The platform’s extensive due diligence ensures that only about 5% of considered investments are accepted. This rigorous process aligns with the need for understanding market trends to offer quality investments.

EquityMultiple provides a range of benefits, including a diversified portfolio with lower correlation to stocks and bonds. Historical risk-adjusted returns are attractive, with less volatility compared to stocks. Investors have access to a preferred asset class of institutions and sophisticated investors. Professional asset management aims to maximize returns and protect capital.

| Feature | Details |

|---|---|

| Minimum Investment | $5,000 for general opportunities |

| Special Offerings | Minimum $25,000 (e.g., Marriott Nashville Development) |

| Refund Policy | High risk, speculative investments with no guaranteed returns |

For investors interested in EquityMultiple, it’s important to note that it’s suitable only for accredited investors. The platform emphasizes the necessity of consulting financial professionals before investing due to the speculative nature of private placements.

Key Trends Shaping The Real Estate Industry

The real estate industry is constantly evolving. Several trends are shaping its future. Understanding these trends is crucial for investors and stakeholders. From remote work to sustainability, each trend offers unique opportunities and challenges.

The Rise Of Remote Work And Its Impact

Remote work is changing real estate dynamics. With more people working from home, demand for residential spaces is rising. Urban areas see shifts as people move to suburban and rural locations. Offices are transforming into flexible workspaces, adjusting to the new normal.

This trend affects commercial real estate. Businesses need less office space, impacting rental prices and availability. Investors must adapt to these changes. They can focus on properties that accommodate remote work needs.

Sustainability And Green Building Practices

Sustainability is a key focus in real estate. Green building practices are on the rise. Energy-efficient buildings are in demand. They reduce environmental impact and offer cost savings.

Investors and developers are prioritizing eco-friendly designs. This includes using sustainable materials and renewable energy sources. The trend enhances property value and attracts environmentally conscious buyers.

Technological Advancements In Real Estate

Technology is revolutionizing real estate. Innovations improve operations and customer experience. Virtual tours and AI-driven analytics are becoming common.

Real estate platforms like EquityMultiple provide online investment opportunities. These platforms simplify access to commercial real estate. They offer vetted projects and professional asset management.

Technology also enhances property management. Smart home features and IoT devices increase efficiency. Investors can leverage technology to make informed decisions and maximize returns.

Challenges Facing The Real Estate Market

The real estate market faces various challenges that impact growth and stability. From economic fluctuations to changing consumer preferences, these obstacles demand careful navigation. Understanding these challenges can help investors make informed decisions.

Economic Uncertainty And Market Volatility

Economic fluctuations often cause market volatility in real estate. Factors like inflation, interest rates, and global economic events affect property values and investment returns. Investors face unpredictability in both short-term and long-term outlooks. This uncertainty can lead to cautious investment strategies.

| Factors | Impact |

|---|---|

| Inflation | Increases costs and affects property values |

| Interest Rates | Influences mortgage affordability |

| Global Events | Causes market shifts and volatility |

Regulatory Changes And Compliance Issues

Regulatory changes create hurdles for real estate investors. New laws and guidelines demand compliance, affecting operations and profitability. Navigating these rules requires knowledge and adaptability. Compliance issues can lead to increased costs and complexity in transactions.

- Changes in zoning laws

- Environmental regulations

- Tax policy adjustments

Shifts In Consumer Preferences And Demographics

Consumer preferences evolve with demographic shifts, impacting real estate demand. Millennials prioritize urban living and amenities, while older generations seek suburban comfort. Understanding these preferences is key to meeting market demands. Real estate trends adapt to these shifts, influencing development and investment strategies.

- Urban vs. suburban living

- Preference for amenities

- Demographic trends

Investors must monitor these trends to align with consumer needs and optimize opportunities.

Credit: extension.harvard.edu

Navigating Economic Uncertainty

Real estate markets often face economic uncertainty. This can make investment decisions challenging. Fluctuations in the economy create both risks and opportunities. Understanding how to navigate these changes is crucial. By employing strategic approaches, investors can mitigate risks and seize opportunities. This section explores strategies and opportunities during uncertain times.

Strategies For Mitigating Risks

Investors need to adopt strategies to reduce risks in uncertain economies. Here are some effective methods:

- Diversification: Invest in a mix of real estate assets. This lowers risk by spreading investments across various properties.

- Thorough Research: Conduct extensive due diligence on potential investments. This includes market analysis and property evaluations.

- Liquidity Management: Maintain sufficient liquid assets. This ensures you can cover unforeseen expenses without stress.

- Professional Guidance: Consult financial professionals. Their expertise can provide valuable insights and risk assessments.

Platforms like EquityMultiple offer a simplified approach to real estate investing. They provide access to vetted real estate projects. This reduces the complexity of managing individual investments.

Opportunities In Times Of Change

Economic changes can open new doors for savvy investors. Recognizing these opportunities is key to success:

| Opportunity | Details |

|---|---|

| Private Market CRE: | Offers access beyond traditional stocks and bonds. The lower correlation reduces volatility and enhances returns. |

| Preferred Asset Classes: | Invest in assets favored by institutions. These often provide stable returns. |

Platforms like EquityMultiple allow investment in the preferred asset class of sophisticated investors. They offer a minimum investment starting at $5,000. This enables diversification even for smaller portfolios.

In economic shifts, being proactive is vital. By understanding risks and identifying opportunities, investors can thrive. With the right strategies, navigating uncertainty becomes manageable.

The Role Of Technology In Real Estate

Technology is reshaping the real estate landscape. With innovative solutions, buyers and sellers experience enhanced efficiency and convenience. From artificial intelligence to virtual reality, technology offers powerful tools for decision-making and investment.

The Impact Of Ai And Big Data

Artificial Intelligence (AI) is transforming how real estate data is analyzed. AI algorithms can quickly assess property value, predict market trends, and optimize investment strategies. This capability provides investors with insights previously unavailable.

Big Data plays a crucial role in real estate. It aggregates vast amounts of information from various sources. This data helps in understanding market dynamics, consumer preferences, and property performance. Investors benefit from more accurate forecasts and risk assessments.

| Technology | Benefits |

|---|---|

| AI | Efficient data analysis and market prediction |

| Big Data | Enhanced market insights and risk management |

Virtual Reality And Digital Tours

Virtual Reality (VR) offers immersive experiences for property tours. Buyers can explore properties from anywhere, saving time and resources. VR technology provides a realistic view, helping buyers make informed decisions.

Digital Tours enhance accessibility and convenience. They allow potential buyers to view multiple properties without physical travel. This technology is essential for international investors and those with busy schedules.

- VR provides a realistic property experience.

- Digital Tours increase accessibility for buyers.

- Ideal for international and busy investors.

These technological advances are crucial for platforms like EquityMultiple. They offer accredited investors vetted opportunities in private-market commercial real estate. With technology, EquityMultiple ensures a streamlined and informed investment process.

Sustainability: A Growing Priority

Real estate markets are increasingly focusing on sustainability. This shift reflects a global recognition of environmental responsibility. Buyers and investors now prioritize eco-friendly features in properties. Developers are responding by integrating sustainable practices. These changes affect both residential and commercial properties.

The Importance Of Energy Efficiency

Energy efficiency is crucial in modern real estate. Efficient buildings reduce energy consumption and lower costs. This attracts environmentally conscious buyers. Properties with energy-saving technologies often see increased demand. Features like smart thermostats and solar panels are popular. They enhance the property’s value and appeal.

- Lower utility bills

- Reduced carbon footprint

- Improved property values

Government incentives support energy-efficient developments. Many regions offer tax rebates. These encourage homeowners and developers to invest in sustainable technologies. Energy-efficient homes are not only environmentally friendly but also economically advantageous.

The Demand For Eco-friendly Developments

Eco-friendly developments are gaining traction. Consumers seek properties with sustainable materials. They prefer constructions that minimize environmental impact. This trend influences urban planning and architectural designs. Developers focus on using recycled and locally-sourced materials. Green spaces within properties are increasingly popular.

Several factors drive this demand:

- Increased environmental awareness

- Desire for healthier living environments

- Long-term cost savings

Real estate platforms like EquityMultiple offer investment opportunities in sustainable projects. They provide access to vetted eco-friendly developments. Investors can diversify portfolios while supporting green initiatives. Such investments often lead to attractive returns.

| Eco-friendly Features | Benefits |

|---|---|

| Solar Panels | Reduce electricity costs |

| Green Roofs | Improve air quality |

| Rainwater Harvesting Systems | Conserve water resources |

Eco-friendly developments are no longer niche. They are mainstream and expected by buyers. Sustainable practices in real estate are essential. They reflect a commitment to preserving the planet for future generations.

Pricing Trends And Affordability Challenges

The real estate market is constantly evolving. Understanding pricing trends and affordability challenges is crucial for investors. As prices fluctuate, affordability and accessibility become key concerns. Let’s delve into these aspects to grasp their impact on real estate investments.

Understanding Pricing Fluctuations

Real estate prices can vary due to several factors. Economic conditions, interest rates, and demand all play a role. For instance, when interest rates drop, borrowing becomes cheaper. This can increase demand and push prices up.

Additionally, urban areas often experience higher price growth. This is due to limited space and high demand. Investors should monitor these trends carefully. Staying informed helps in making better investment decisions.

| Factor | Impact on Prices |

|---|---|

| Interest Rates | Lower rates can increase demand and prices |

| Economic Growth | Strong growth can lead to higher prices |

| Demand | High demand can drive prices up |

Affordability And Accessibility

Affordability is a growing challenge in the real estate market. Many potential buyers find it hard to enter the market. High prices in urban areas make it difficult for first-time buyers.

Accessibility is another concern. It refers to how easily buyers can enter the market. High entry costs and stringent requirements often limit access. Platforms like EquityMultiple aim to bridge this gap.

- Minimum investment starts at $5,000.

- Specific projects, like the Marriott Nashville, need $25,000.

These options provide more flexibility for investors. By offering lower entry points, such platforms increase market accessibility. This can help diversify investment portfolios and mitigate risks.

Understanding these challenges aids in making informed investment choices. It also highlights the importance of strategic planning and research.

Credit: seekingalpha.com

Pros And Cons Of Current Market Trends

The real estate market is ever-changing, offering both opportunities and challenges. Understanding the pros and cons helps navigate these shifts effectively. Whether you’re a buyer or a seller, knowing these dynamics can guide better decisions. Let’s explore the advantages and potential risks in today’s market.

Advantages For Buyers And Sellers

Current trends present unique advantages for both buyers and sellers:

- Buyers: Low interest rates make financing attractive. More properties are available, offering varied choices. New platforms, like EquityMultiple, simplify investments.

- Sellers: High demand keeps prices stable. Sellers can benefit from quick transactions. Online tools enhance visibility and marketing.

Platforms such as EquityMultiple offer access to vetted real estate projects. This aids both buyers and sellers in optimizing their portfolios. With a focus on institutional diligence, investors can achieve attractive returns.

Potential Drawbacks And Risks

Despite benefits, there are notable risks:

- Market Volatility: Real estate can be unpredictable. Prices may fluctuate, impacting investment value.

- Investment Liquidity: Long-term commitments are necessary. Investments may remain illiquid for years, limiting cash flow.

- High Risk: Speculative investments carry potential losses. Consult financial advisors before engaging in private placements.

EquityMultiple emphasizes the importance of understanding these risks. With a rigorous vetting process, only about 5% of opportunities are accepted. This ensures investors are engaging in thorough and well-managed projects.

Recommendations For Navigating Today’s Market

Understanding the current real estate market can be challenging. Fluctuating prices and changing interest rates make it even more complex. Whether you’re a seasoned investor or a first-time homebuyer, having a strategy is essential. Here are some recommendations to help you succeed in today’s market.

Tips For Real Estate Investors

- Diversify your portfolio: Consider platforms like EquityMultiple for passive real estate investment. This platform allows investment in vetted opportunities, reducing risk.

- Understand market trends: Keep an eye on economic indicators. They can affect real estate prices and demand.

- Evaluate risk: Real estate investments can be speculative. Assess the potential for both gains and losses.

- Commit to long-term investments: Real estate investments often require 5-7 years or longer.

- Leverage professional advice: Consult with financial professionals to align your investments with your goals.

Guidance For Homebuyers And Sellers

The market offers different challenges for homebuyers and sellers. Here’s some guidance:

| For Homebuyers | For Sellers |

|---|---|

| Research local markets: Prices vary by region. Understanding local trends is crucial. | Price competitively: Set a fair price to attract buyers in a competitive market. |

| Get pre-approved: Strengthen your position by securing financing early. | Enhance curb appeal: First impressions matter. Ensure your property looks inviting. |

| Be flexible: The best properties go quickly. Be ready to act fast. | Highlight unique features: Make your home stand out by showcasing its best attributes. |

Both buyers and sellers should stay informed. Market conditions can change rapidly, impacting decisions and outcomes.

Conclusion And Future Outlook

The real estate market is dynamic, adapting to new trends and challenges. Understanding current trends can guide future investments. As the market evolves, investors must stay informed and strategic. This section summarizes key insights and offers future predictions.

Summarizing Key Insights

The real estate sector shows diverse opportunities for investors. Platforms like EquityMultiple offer access to private-market commercial real estate. These investments provide a chance for portfolio diversification beyond traditional stocks and bonds. The extensive due diligence process ensures only top-tier investments are available, with an acceptance rate of just 5%. Many investors appreciate the professional asset management that aims to maximize returns and protect capital.

| Feature | Details |

|---|---|

| Minimum Investment | $5,000 for general opportunities |

| Special Projects | $25,000 for specific offerings |

| Investment Duration | 5-7 years commitment |

Despite the benefits, private placements carry risks. They are speculative and illiquid, often needing a long-term commitment. Investors should consult financial professionals before committing.

Predictions For Future Trends

As technology advances, the real estate market will likely see more digital platforms. These platforms simplify the investment process and expand access to diverse opportunities. EquityMultiple is a leader in this digital transformation. The focus on institutional diligence and asset management will remain crucial. The market might also see a growing preference for commercial real estate over traditional assets.

- Increased digital platform adoption

- Greater access to commercial real estate opportunities

- Enhanced due diligence processes

Investors should watch these trends to make informed decisions. Staying updated on market changes will help leverage opportunities while managing risks effectively.

Credit: www.linkedin.com

Frequently Asked Questions

Are Home Prices In Austin Dropping?

Home prices in Austin have seen a decrease recently. Market conditions and economic factors influence these trends. Keep an eye on local real estate reports for the latest updates. Buyers may find opportunities, while sellers should strategize carefully.

Are Home Prices In Florida Dropping?

Home prices in Florida have shown some fluctuations recently. Some areas are experiencing price drops due to market adjustments. It’s essential to monitor local real estate trends for accurate insights. Factors like demand, interest rates, and economic conditions significantly influence these changes.

Always consult local real estate experts for precise information.

Are Home Prices In Az Going Down?

Home prices in Arizona are experiencing fluctuations due to changing market conditions. Recent trends show a slight decrease. However, regional variations can occur. It’s essential to monitor local real estate data for precise insights. Buyers and sellers should consult with local experts for the latest updates and strategic advice.

Is The Real Estate Market Trending Down?

The real estate market shows fluctuations based on location and economic factors. Some areas experience a downturn, while others remain stable. Stay informed with local market trends and expert analysis to make informed decisions. Always consider consulting a real estate professional for personalized advice.

Conclusion

The real estate market constantly evolves. Staying informed is crucial. Trends shape future opportunities and challenges. Understanding these shifts aids smart investment decisions. For those seeking passive income, platforms like EquityMultiple offer solutions. Accredited investors can explore EquityMultiple for diversified portfolios. The platform provides access to vetted real estate projects. This ensures quality and reduces risk. Investing in real estate offers potential returns beyond traditional stocks. Always consider risks and consult professionals. Stay updated, invest wisely, and grow your financial future.